SBAB Bank increases results and efficiencies with AI-driven programmatic advertising

Background

SBAB Bank AB (publ), started their business in 1985 and are owned 100 percent by the Swedish state. Their business idea is to offer loans and savings to private individuals, housing associations and real estate companies in Sweden with innovative thinking and consideration.

The challenge

An important finding when Curamando conducted interviews with the digital marketing team at SBAB was that the client put a lot of effort on manual testing. John Eriksson, Senior Growth Expert at Curamando explains:

- The client spent a lot of time manually testing different strategies and trying to find different target groups, retargeting setups, and bidding optimizations.

- They also spent a lot of time adapting banner formats. For each banner produced, there was at least one hour of format adaptation so that the banner could fit different formats used on the Internet. This made the campaign rollouts very slow. Our target was to get rid of retargeting strategy testing and format adaptation altogether so that the team could focus more on strategic issues that the client very much needed.

Curamando also found that the client put a lot of focus on the upper and lower marketing funnel, but had no mid-funnel strategy. In addition to that the majority of the media buying was done in a traditional manner; booking a specific amount of impressions on specific media placements based on demographic data.

SBAB needed to:

- Lower the amount of man-hours that were put into manual testing

- Increase efficiency in banner production

- Target the whole customer journey

- Move from tactical to strategic planning

The solution

Curamando rolled out a new operative model for banner production and media buying.

In this model, BannerFlow, a tool for efficient banner adaptations was introduced. The tool creates templates where banner messages can be inserted dynamically. This tool is ideal if you want to test different messages in different stages of the user journey.

To increase the efficiency of media buying and target the customers throughout the whole customer journey, Curamando implemented a solution for AI-driven programmatic advertising.

The AI can see where the customers are in the user journey by analyzing online behavior data and site data using a probabilistic model. The AI will show the customer emotional messages if they are currently not in the market for a home loan, and show them gradually more rational messaging with clear call-to-action as they approach a conversion. The AI does this by pulling data from the programmatic ad serving space and combining it with data from the client’s site. An AI engine performs thousands of tests every minute.

And it also optimizes on an individual level. The buckets that were previously used for manual testing (retargeting) are human constructs. The AI robot can’t see the buckets; it only sees data points moving towards set goals (or not). An AI is so powerful that it can optimize at an individual level instead of a bucket level. It can find all converters from all buckets.

The result

To prove the effectiveness of the setup, Curamando performed a structured test as a proof of concept. This was done with a test group that was shown regular SBAB banners and a control group that was shown no banners. Identical data and optimization for the groups were used.

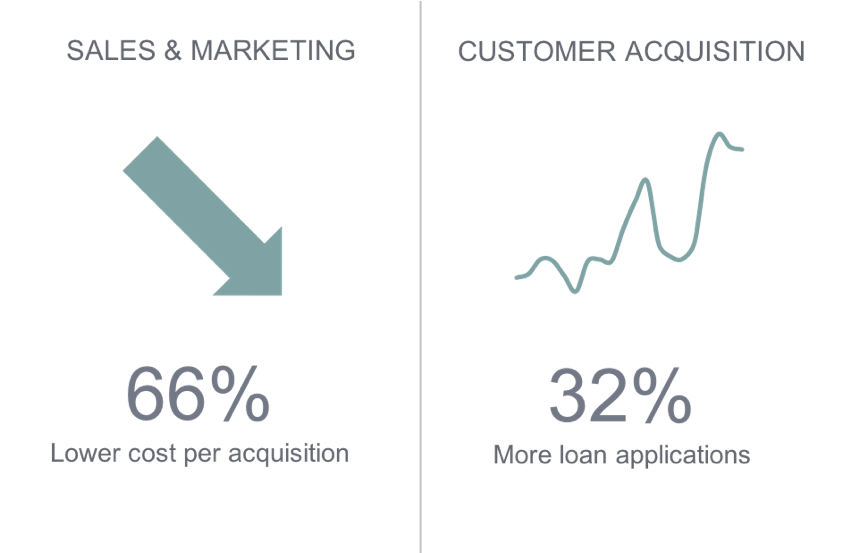

The result showed that the test group received better results with 32% more conversions and 66% less CPA than the control group.

Instead of campaign follow-up meetings 2-3 times per year the client now has a process for constant experimentation and learning.

Key success factors:

- Run the project in-house as a growth project

- The largest part of your effect comes from your data

- Data tags and goals are central to the success

- AI needs data and time to adjust its algorithms

- AI is superior to manual analysis

- AI will make our work more strategic and creative!